Dividend yield is a term that often appears in financial reports, investment newsletters, and stock market analysis. It’s a concept that is simple in theory but carries deep implications for investment strategy. Understanding dividend yield not only helps investors evaluate the income potential of a stock but also offers insight into a company’s financial health and investor appeal. This article will explore the full meaning of dividend yield, how it is calculated, what affects it, and why it matters to both novice and seasoned investors.

Understanding the Basics of Dividend Yield

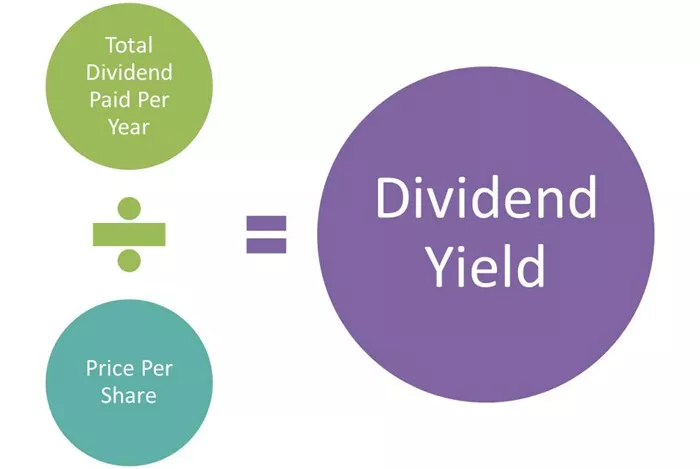

Dividend yield is a financial ratio that indicates how much a company pays out in dividends each year relative to its stock price. In simple terms, it shows the return on investment from dividends alone, excluding capital gains. For instance, if a company pays a yearly dividend of $2 per share and the stock trades at $40, the dividend yield is 5%. This ratio gives investors a sense of how much income they can expect to earn from their investment in relation to the current price of the stock.

This measurement is especially important for income-focused investors who prioritize steady returns over speculative price appreciation. Dividend yield can signal the stability and profitability of a business. Companies with a consistent or rising dividend yield are often considered reliable, especially during periods of market volatility. However, it’s essential to understand that a high dividend yield is not always good news. Sometimes, it can indicate trouble if the stock price has dropped significantly due to company problems.

How Is Dividend Yield Calculated?

The formula to calculate dividend yield is straightforward: divide the annual dividend per share by the current market price of the stock. Then multiply the result by 100 to express it as a percentage. For example, if a stock pays $3 in annual dividends and is trading at $60, the dividend yield is (3 ÷ 60) × 100 = 5%. While this formula is simple, the values used can vary. Some investors prefer using the most recent quarterly dividend and annualizing it, while others rely on the company’s stated annual dividend.

It’s important to use up-to-date information when calculating dividend yield. Market prices fluctuate daily, and dividend policies can change over time. Investors should also distinguish between forward dividend yield and trailing dividend yield. The former uses projected future dividends, while the latter is based on historical payments. Both have their uses depending on the investor’s objectives and whether they prioritize future growth or past performance.

Why Dividend Yield Matters

Dividend yield serves as a powerful tool in evaluating the attractiveness of an investment, especially for income-oriented portfolios. It offers a way to compare the income potential of stocks relative to bonds, savings accounts, and other fixed-income investments. A solid dividend yield can provide a buffer during downturns, as companies that consistently pay dividends often demonstrate financial discipline and robust cash flow.

Moreover, dividend yield is often used to screen stocks. Investors looking for steady income may set a minimum yield threshold when selecting which stocks to include in their portfolios. However, yield should never be analyzed in isolation. A very high yield could suggest the stock is undervalued, but it might also indicate that the dividend is unsustainable. Smart investors dig deeper, evaluating the payout ratio, earnings growth, and the company’s broader financial condition.

Factors That Influence Dividend Yield

Several factors can influence a stock’s dividend yield. The most obvious is the company’s dividend policy. Some firms, especially in mature industries like utilities or consumer staples, maintain high payout ratios and steady yields. Others, particularly growth companies in technology or biotech, may reinvest profits into expansion rather than pay dividends, resulting in a low or zero yield.

Stock price movement is another critical factor. If a company’s stock price falls while the dividend remains unchanged, the yield increases. This can sometimes make the stock look more attractive to income investors. However, it’s important to assess whether the price drop is due to temporary market conditions or deeper financial issues. Currency fluctuations, interest rates, and broader economic trends also affect dividend yields, especially for multinational corporations.

Comparing Dividend Yields Across Sectors

Not all sectors are created equal when it comes to dividends. For example, real estate investment trusts (REITs) and utility companies often offer higher-than-average yields because they are legally required to distribute a large portion of their earnings as dividends. On the other hand, sectors like technology or healthcare typically have lower yields due to their focus on reinvestment and innovation.

When comparing dividend yields across sectors, context is everything. A 4% yield in the tech sector might be unusually high and worth investigating, while the same yield in the utility sector might be considered average. It’s also useful to compare dividend yields to the sector average or to historical trends within the same company. These comparisons help investors make informed decisions rather than simply chasing the highest yield available.

The Role of Dividend Yield in Total Return

Dividend yield is only one part of the total return an investor can earn from a stock. The total return includes both capital appreciation (the increase in stock price) and income from dividends. A stock with a modest dividend yield but strong growth potential may deliver better returns over time than a high-yield stock with limited growth prospects. Therefore, investors should always consider dividend yield within the broader context of total return.

In long-term investing, dividends can significantly enhance total returns through reinvestment. Reinvesting dividends allows investors to buy more shares, which in turn generate more dividends. This compounding effect can lead to substantial portfolio growth over decades. Many brokerage firms offer dividend reinvestment plans (DRIPs) that automate this process, making it easy for investors to grow their holdings over time.

Common Pitfalls When Using Dividend Yield

While dividend yield is a useful metric, it has limitations. One common mistake is assuming that a high yield guarantees a good investment. In reality, a high yield can be a warning sign. If a company’s earnings are declining or its industry is struggling, the dividend may soon be cut, leading to further stock price declines. This situation is sometimes referred to as a “dividend trap.”

Another pitfall is ignoring the payout ratio, which indicates how much of a company’s earnings are paid out as dividends. A very high payout ratio may be unsustainable, especially if earnings fluctuate. Ideally, investors should look for companies with a healthy balance between paying dividends and reinvesting profits. A sustainable dividend is often supported by strong cash flow, low debt levels, and a clear long-term strategy.

Historical Perspective on Dividend Yields

Dividend yields have changed significantly over time, reflecting shifts in market conditions, interest rates, and corporate behavior. In the early 20th century, dividends were the primary source of return for most investors. Over the past few decades, however, capital appreciation has become more important, especially during bull markets. Still, dividend-paying stocks have remained a crucial component of many portfolios, particularly for retirees and conservative investors.

During periods of economic uncertainty, dividend-paying stocks tend to outperform the broader market. This is because they offer a tangible return even when stock prices are volatile. For instance, during the 2008 financial crisis, companies with stable dividends weathered the storm better than many growth-focused firms. This historical performance underscores the value of dividends as a source of stability and income.

Final Thoughts

Dividend yield is a powerful and widely used metric in the world of investing. It provides insight into a company’s ability to return value to shareholders through regular payments. While it’s not the only measure of a stock’s quality, it plays a central role in assessing income potential and overall financial health. Smart investors use dividend yield in conjunction with other metrics like earnings growth, payout ratio, and total return to build robust, diversified portfolios.

Whether you’re a retiree seeking income or a long-term investor aiming to grow your wealth, understanding dividend yield can enhance your investment decisions. It bridges the gap between risk and reward, offering a window into both the present state of a company and its future prospects. By keeping a close eye on dividend yields and the factors that influence them, you can make more informed, strategic choices in a constantly evolving market.

Related Topics:

How Do Stocks and Shares ISAs Operate?